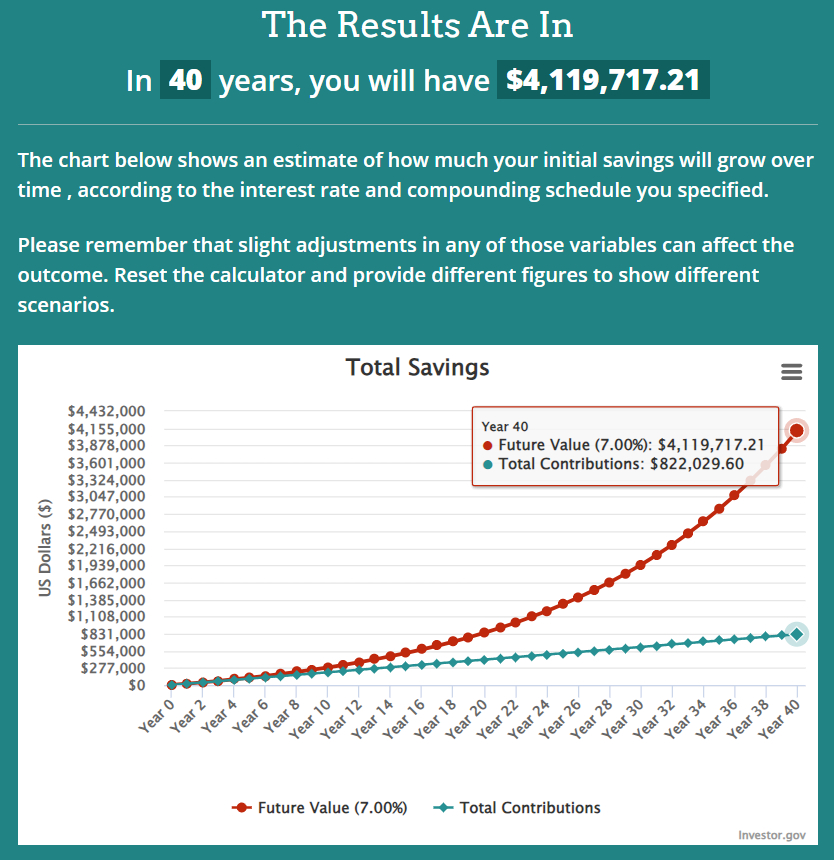

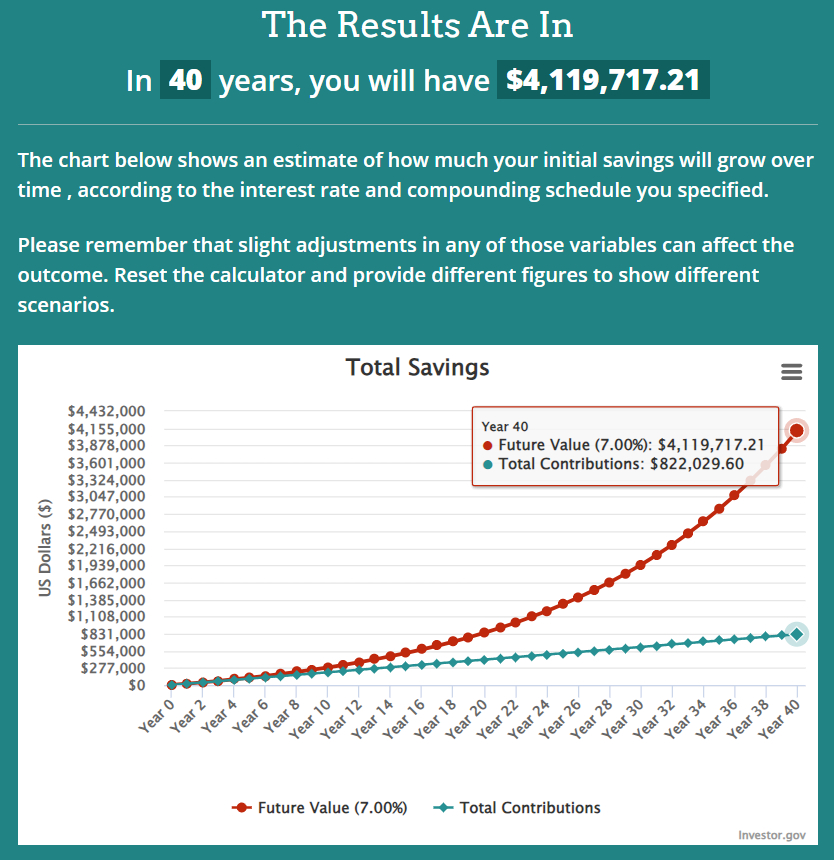

Planning for my future will be super important as I begin my working life. The best way I can do this is with a retirement account. Epic offers a 401k with a "competitive match", so I would use that up to the match then put the rest of my retirement money into a Roth IRA. If we assume the match is 5%, this is what the retirement accounts would look like after 40 years (10% in 401k and 10% in IRA):

Since the 401k is pre-tax with a 5% match, I will be putting 5% of $7,634, so $381.70, into it every month. Since the Roth is post-tax, I will be putting 10% of $5,645, so $564.50, into it every month. This means that I will be putting 15% into retirement accounts, but with the match it will be a total of 20%. After 40 working years with a 7% average return, I would end up with over 4 million dollars in my retirement accounts combined, which is more than enough to retire on.

Clearly, there is a very high chance I won't be working at the same place in 40 years, but hopefully I will only continue to move up the ladder, and will be able to retire on an amount similar to this.